Empowering Banks with

The NXT-Gen Digital Front

Office

Whether emerging Neo or established bricks and mortar, our banking platform has been engineered to seamlessly incorporate our highly regarded client management system and mobile-first digital front office.

Technology Challenges

- Legacy infrastructure modernization.

- Rapid implementation of digital banking capabilities.

- Data quality and data integrity.

- Security, identity and privacy.

- Modernizing the workplace.

- Adapting the cloud, where needed.

Product Overview

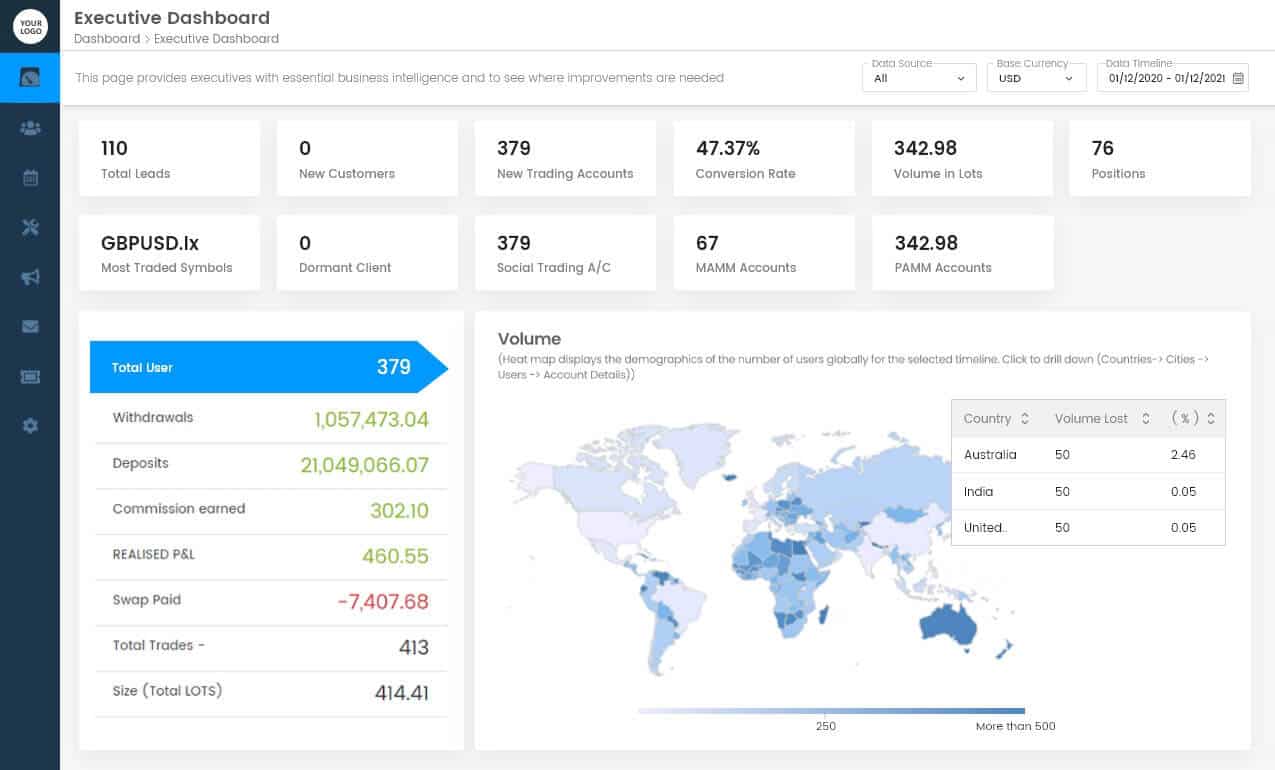

Client Manager

A comprehensive solution for Multi-Asset brokers to optimally manage their Clients, Compliance, Sales & Operations etc.

Below are some of the key highlights:

- Client Management

- Service Tickets

- Sales Management

- Reports & Dashboards.

- Client Portal Configurations.

- Integrated with interactive brokers and other reputed trading platforms.

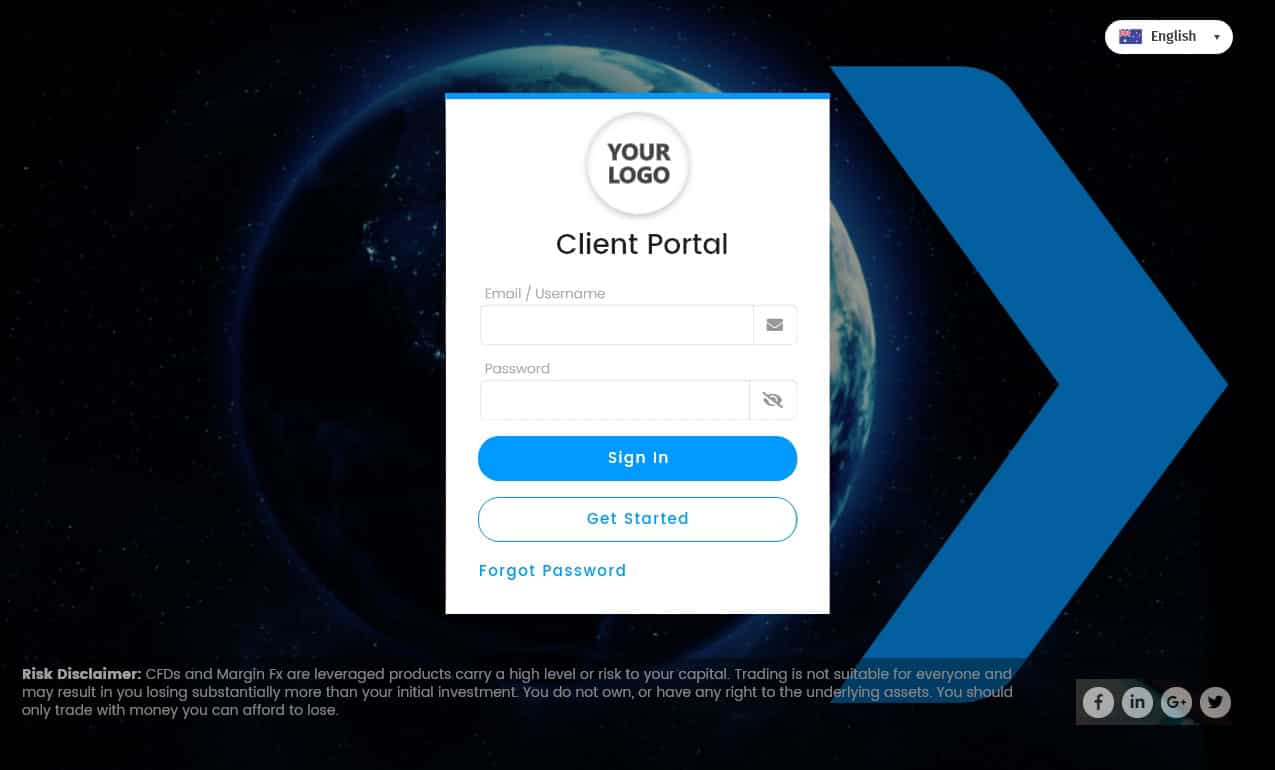

Client Portal

A rebranded client portal specifically designed to provide a unified and intuitive user experience for your clients.

Below are some of the key highlights:

- Digital Onboarding.

- Intuitive Dashboard.

- Account Management.

- Multi-Currency Wallet.

- Statements & Reports.

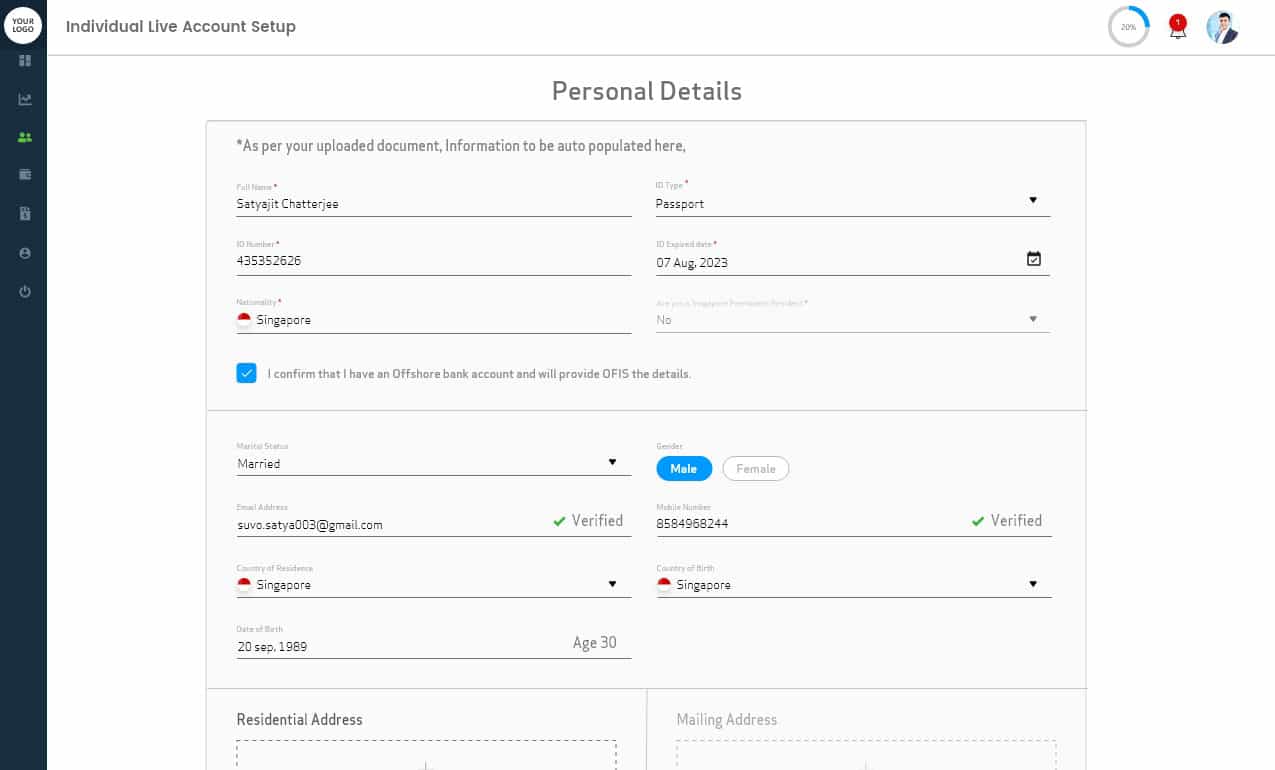

Digital Onboarding For both Retail and Institutional Clients

Clients can easily, onboarded regardless of channel – in-branch, laptop, tablet and mobile, all the while ensuring a consistent experience.

Below are some of the key highlights:

- Mobile first design.

- Built-in two Factor authentication.

- Integrated Docu-sign.

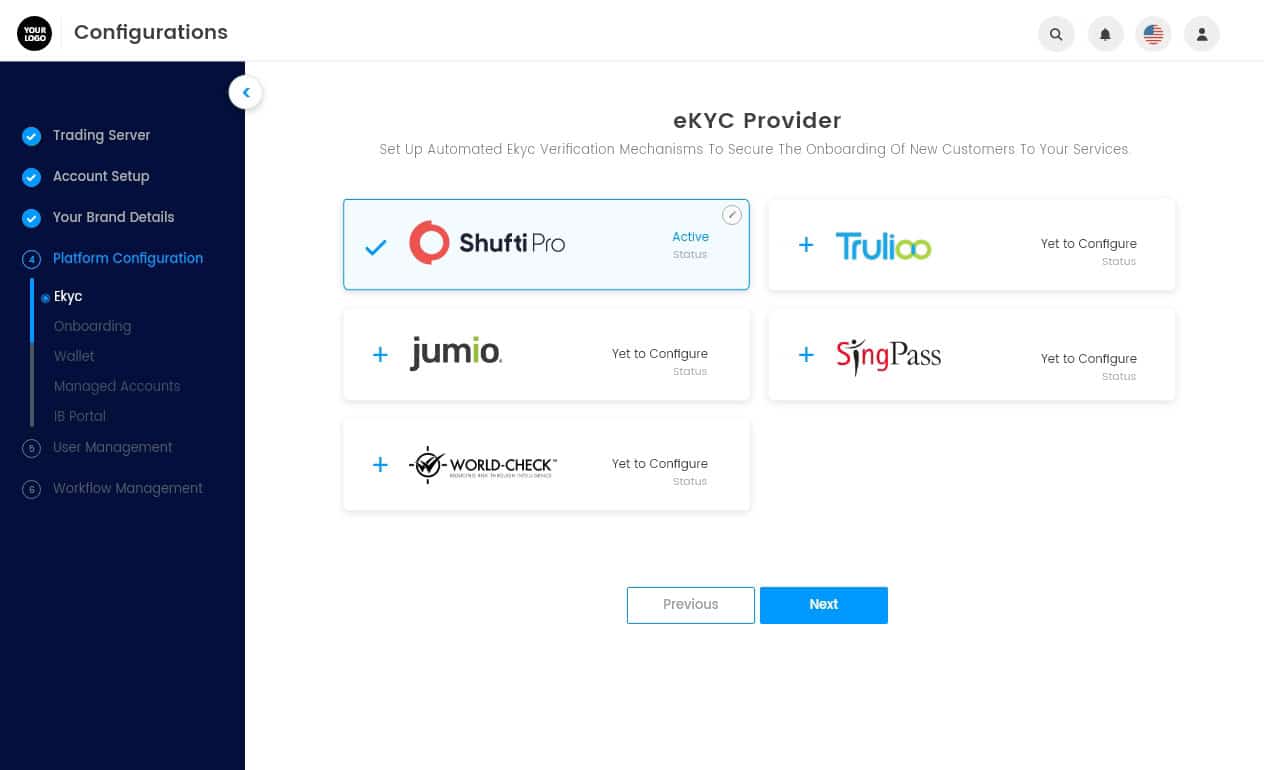

- Integrated eKYC, AML, PEP checks.

- Extendible Client Portal with Intuitive Dashboards and Integrations.

- Built-in Communication Channels (Email / SMS / Whatsapp / Help Desk.

Headroom to Grow

With our open APIs and infinitely extensible architecture, our platform delivers peerless client experience solutions, that grows in step with your business. Need to pivot? No problem, we’ll gladly assist/help you.

Secure Authentication & Identity Management

Provide convenient and secure identity verification across channels. Reduce fraud and know who your client is.

- Biometrics, e-Signature, OTP, integrations with National ID Registries and more.

- Pre-integrated with market-leading Identity Access Management (IAM) providers.

- Ability to embed, any third-party KYC technology via APIs.

Benefits

Quickly launch new digital products and services. Start fast with what you need and scale as you grow. Adapt new technologies with ease.

Innovate without replacing costly systems and easily scale beyond your core. Streamline processes to boost operational efficiency.

Rethink the ways clients interact with you across channels. Become your client’s “everyday bank”, exceeding expectations.

Integrate any regulation or risk requirements, end-to-end across process workflows (PSD2, GDPR, AML, FATCA, etc.)

Monetize the open banking opportunity. Integrate with your value-chain partners to create client values and unlock new revenue streams.

Win in the digital race with a modular and scalable digital banking platform, supporting your digital growth ambitions.